Comment: UBS Chief Investment Office GWM

The European Central Bank cut interest rates by 25 basis points at its March meeting, taking the deposit rate to 2.5%, in line with our and market expectations.

The initial press release was regarded as somewhat hawkish, but as the accompanying press conference unfolded on Thursday, it became clear that the Governing Council wishes to retain some optionality on the timing and extent of future policy easing. Hence, investors looking for more clarity on whether another rate cut is forthcoming in April will likely be disappointed.

However, with disinflation still well on track, there is little reason for the ECB to interrupt its cutting cycle next month.

Lower growth, “phenomenal” uncertainty

One reason why this meeting had been eagerly anticipated is the new set of forecasts compiled by ECB staff, which could hint at the Governing Council’s intentions for upcoming meetings.

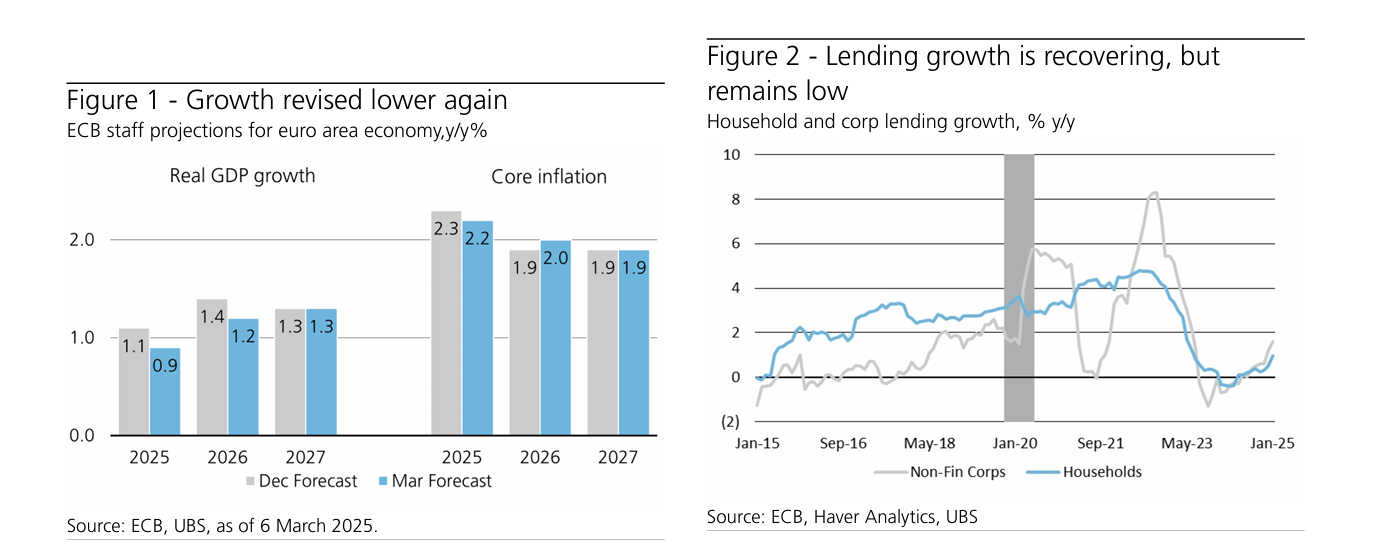

In the end, we got a mixed message: while growth was marked lower over the next two years on account of weaker investment and trade dynamics, partly reflecting the rising uncertainty about trade policy, the forecast for headline inflation was increased from 2.1% to 2.3% y/y this year, due to rising energy prices.

On a core basis, which strips out volatile energy and food prices, the forecast also saw mixed revisions (Figure 1). Broadly, however, the release still points to the ECB reaching its inflation target in a timely manner and suggests that further interest rate cuts are in order.

However, as interesting as the narrative of these tweaks is, it’s what they don’t tell us that might matter more for the future policy course. With the economy facing a level of uncertainty that some Governing Council members described as “phenomenal” in light of the evolving trade, fiscal, and energy landscape, the forecasts risk becoming obsolete not long after their publication.

However, as interesting as the narrative of these tweaks is, it’s what they don’t tell us that might matter more for the future policy course. With the economy facing a level of uncertainty that some Governing Council members described as “phenomenal” in light of the evolving trade, fiscal, and energy landscape, the forecasts risk becoming obsolete not long after their publication.

Indeed, already during the press conference, President Christine Lagarde caveated the higher inflation forecast for this year with a reference to the recent reversal in energy prices. She also made clear that recent announcement on fiscal policy out of Germany has not yet been incorporated into the projections.

Thus, while ECB watchers should have gotten used to the central bank’s “meeting-by-meeting” approach by now, this rings particularly true at the moment.

However, putting aside some of these uncertainties that can only be resolved with time, we take comfort from the fact that incoming data seem to confirm the ECB’s view of a well-established disinflationary trend.

Combined with downside risks to the growth in the near term, this should provide room to continue with the cutting cycle in April.

Less, but still restrictive

Most of the attention honed in on the change in language of the press release announcing the policy decision, which suggested that policy is “meaningfully less restrictive” than previously.

When pushed on the not-so-subtle change in tone, the ECB President explained that in the first instance, it is merely a statement of the obvious given rates are 150bps lower than their peak. However, Lagarde then went on to explain that justification for this can also be found in the lending data.

As shown in Figure 2, lending growth for both households and companies has improved as monetary conditions have eased

Unquestionably, demand for lending has recovered in recent months, but it is only rising at less than 1% for households and less than 2% per year for firms.

Moreover, there is high uncertainty about the outlook from here, which could weigh on demand for borrowing for both firms and households. Hence, we caution against an overly hawkish interpretation of the change in language.

Implications for investors

There were few surprises from Thursday’s statement and press conference. Uncertainty remains high not only around the economy and inflation, but around the timing and extent of future rate cuts.

However, ongoing monetary easing, fiscal policy, and a potential ceasefire in Ukraine in the coming months remain supportive for Eurozone equity and bond markets.

In equities, this favours a selective approach, and we continue to recommend gaining exposure to the DAX through structured strategies or, more selectively, via our “Six Ways to Invest in Europe” theme. Alternatively, we still see the EMU industrial sector, as well as EMU small and mid-caps as Attractive.

In bonds, following the sharp sell-off on the back of the fiscal announcement from Germany, in the absence of additional shocks to economic growth or events raising the debt load, we believe the country will retain its Aaa/AAA credit ratings.

While long-dated bonds will likely remain volatile on the path to finalising these new spending programmes, we view this as a buying opportunity for medium tenor quality corporate bonds and expect yields to decline, boosting expected total returns to the mid-single digits over the next 12 months.

As for the euro, uncertainty persists, with the main risk being the threat of tariffs.

In recent days, US authorities have imposed 25% tariffs on certain Canadian and Mexican imports, plus an additional 10% on select Chinese goods. It is only a matter of time before European exports are subjected to similar treatment, which would likely put downward pressure on EURUSD.

After the recent rally in EURUSD above 1.07, the upside is limited and that a setback appears likely. In this context, we also believe speculative accounts have turned marginally net-EUR long, as shorts have been squeezed out.

By Dean Turner, Economist, UBS AG, UBS AG London Branch; Samuel Adams, Economist, UBS AG, UBS AG London Branch; Thomas Wacker, CFA, Head CIO Credit, UBS Switzerland AG; Fabian Deriaz, Strategist, UBS Switzerland AG; Constantin Bolz, CFA, Strategist, UBS Switzerland AG