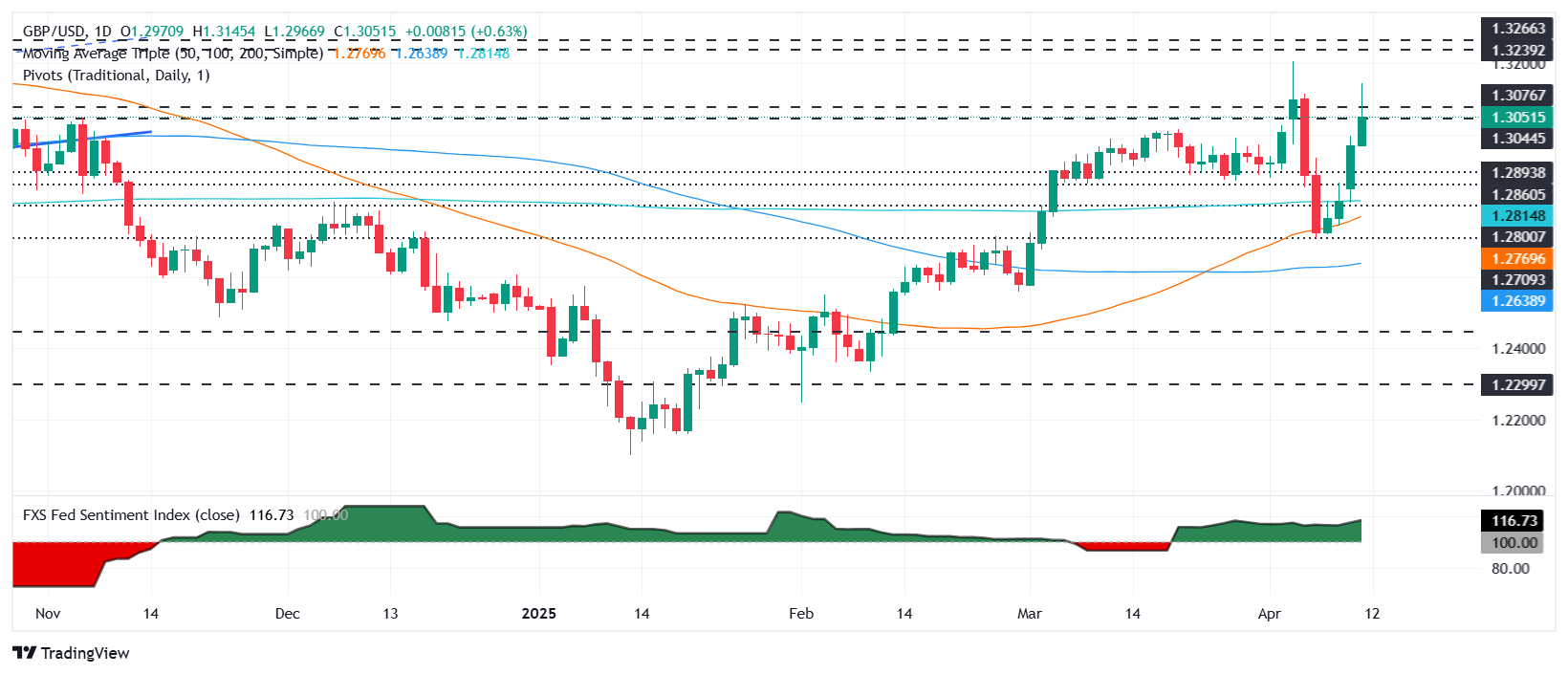

The Pound Sterling extends its gains versus the US Dollar as the US-Sino trade war escalates, with China imposing 125% tariffs on US goods. Trade policies continue to drive price action, with economic data taking a backseat. By late Friday, the GBPUSD pair traded at 1.3067, up 0.77%.

GBPUSD jumped 0.77% amid deepening trade war and weak US data; UK growth surprise offers Sterling support

In the latest news, China retaliated against US President Donald Trump’s decision to increase duties to 145% on Chinese products. Beijing called the actions a “joke” and said it no longer considers them worth matching.

The economic docket revealed that US Consumer Sentiment deteriorated, according to the University of Michigan. The index dipped from 57.0 to 50.8 in April. Inflation expectations for one year rose from 5% to 6.7%, and for a five-year period, they increased from 4.1% to 4.4%.

The US Producer Price Index (PPI) fell from 3.2% to 2.7% YoY in March, below estimates of 3.3%. Despite this, Core PPI remained above the 3% threshold at 3.3% YoY, below February’s 3.5%, lower than forecasts of 3.6%.

Meanwhile, Federal Reserve speakers crossed the wires.

Minneapolis Neel Kashkari said the CPI report contained good news, though he reaffirmed that inflation remains elevated. Boston Fed Susan Collins said her outlook for the year is higher inflation and slower growth, while St. Louis Fed Alberto Musalem said inflation could climb even as the labor market softens.

Across the pond, the UK’s economy grew above estimates, rising 0.5% in February, beating economists’ estimates and providing some relief for Chancellor Rachel Reeves.

USDJPY drops to seven-month lows near 142.00

USDJPY added to the pessimism seen in the latter part of the week and receded to the 142.00 region on Friday, an area last seen in late September.

The continuation of the noticeable appreciation of the Japanese currency put the pair under extra downside pressure, always on the back of heightened concerns surrounding the US-China trade scenario.

On the latter, China announced 125% levies on US imports, counterbalancing Trump’s recently announced 145% tariffs on the country.

GBPUSD chart by TradingView

(Source: OANDA)